Key #1 – Work History

Lenders require a source of income sufficient to pay of your new mortgage. For the vast majority of individuals, that income comes from a job. Income from retirement, alimony, or child support can also be considered when qualifying.

Good: Having a Job

All loan programs require a source of income; generally, from a job.

Better: A Two-Year Job History

Most loans require a two-year work history. Sometimes we can patch together multiple jobs and schooling and even church missions to get to two years, when applicable. It is best to avoid big gaps in your employment history.

Best: A Two-Year Job History in The Same Line of Work

Having a solid two-year job history in the same line of work with the same pay structure (e.g., salary vs. commission) is most likely to qualify you for a loan. Some loan programs require your work to be in the same field; others are more flexible.

Key #2 – Credit Score

A great credit score gives you better pricing in terms of your interest rate and sometimes mortgage insurance. That translates to a lower monthly payment and less interest paid over the life of the loan.

Good: 640

A score of 640 or better qualifies for almost all loan programs. Limited options are available for scores between 580 and 640.

Better: 720

Scores over 720 offer better loan terms and lower payments.

Best: 760+

Credit score that are 760 and better prove that you have good money management practices and that results in the least expensive loan possible.

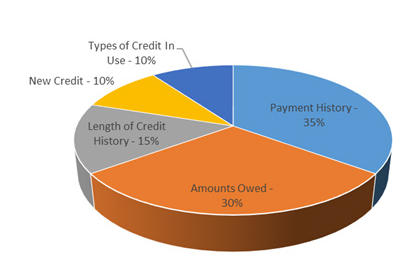

THE 5 BIGGEST CREDIT FACTORS

Your payment history is the biggest factor that effects your score. Paying all your bills on time and keeping your report free from collections and judgments helps keep your score up. The second biggest factor has to do with the amount you owe in relation to your available credit. Keep your revolving credit balances low to keep your credit score high!

Key #3 – Down Payment

Your down payment can come from your own savings, the sale of a home, a retirement account, or can be gifted from a family member.

Good: 3.5% Down Payment

3.5% down qualifies you for an FHA loan. FHA loans are a good choice if you have a small down payment or a low credit score. FHA loans have upfront mortgage insurance and monthly mortgage insurance for the life of the loan.

Better: 5% Down Payment

5% down qualifies you for a conventional loan. Conventional loans don’t have upfront mortgage insurance but they do require you to pay for monthly mortgage insurance until you reach 20% equity in the home.

We also have some conventional loan programs for qualified borrowers that allow for only 3% down!

Best: 20% Down Payment

20% down qualifies you for a conventional loan without mortgage insurance.